Kraken Robotics (PNG) - "Do you believe in ma....nagements guidance?"

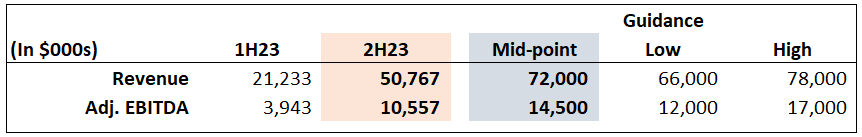

Guiding for 2023 revenue of $66-78m and Adjusted EBITDA of $12-17m

Disclosure: I hold a position in Kraken Robotic Inc shares. Nothing here constitutes investment advice or solicitation to buy or sell securities and is my own opinion. Please do your own due diligence before buying or selling any securities.

This post will highlight what I think is a great opportunity to get into a microcap company at a decent valuation. Management has guided FY23 revenue of $66-78m and $12-17m in Adjusted EBITDA; more importantly, management has a proven track record of achieving its guidance. The opportunity exists due to 2H23 numbers likely being far greater than 1H23, which have already been reported. For 1H23, the company did ~$21m in revenue and ~$4m in adjusted EBITDA. For those of you without a calculator at home, assuming management hits the mid-point of their guidance (which they’ve reiterated several times since reporting 2Q), that implies revenue of ~$51m and adjusted EBITDA of $10.5m in the back half of 2023. So I ask you, do you believe in managements guidance?

First, I would like to highlight two write-ups on the opportunity that go into far greater detail on the actual business than this write up will. I invite you to read both if you’d like to get a more qualitative take on the business - both are very well written and do a much better job of describing all the aspects of the business than I ever could. This write up will solely focus on quantitative aspects.

So to answer the question of do you believe in managements guidance, the best way to gain confidence in their guidance is by checking to see if they’ve historically given guidance and met or exceeded their targets. In Whiteout Capital’s research, we read that management has indeed met or exceeded their guidance several times in the past. Management confirmed as much during our recent meeting. I am happy to present my findings and confirm that management has hit its guidance on revenue and adjusted EBITDA multiple times in the past.

Historic Guidance and Results

FY2019 Outlook

o “Forecasting More than 100% revenue growth and positive net income in 2019”1

· Actual Results

o Revenue increased 126% yoy = Achieved

o Net income was -$3.0m = Missed

·

FY20 Outlook - Unable to find FY guidance (not surprising due to COVID)

FY21 Outlook2

o Revenue between $24.0 to $28.0m

o Gross margin between 47-50%

o Adjusted EBITDA between $2.0 to $4.5m

o Net income between -$1.5 to $1.5m

· Actual Results

o Revenue of $25.6m = Achieved

o Gross margin of 44% = Miss

o Adjusted EBITDA of $2.1m = Achieved

o Net Income of -$3.5m = Miss

FY22 Outlook3

o Revenue $36.0 to $42.0m

o Adjusted EBITDA $5.0-$7.0m

· Actual Results

o Revenue $41.0m = Achieved

o Adjusted EBITDA of $5.3m = Achieved

From managements previous track record, I think we see a clear trend of hitting the revenue growth and adjusted EBITDA (on the low end) milestones while missing on margin/net profitability. We see management refrain from giving margin outlook in FY22 after missing in FY21. This is mostly due to the product/service mix Kraken offers and the lumpiness in its revenue. I would also add that revenue is recognized on a “percentage of completion” method, and that the company receives money for its services in installments. Today, it receives 25% of the contract value up front in order to protect itself/run the business (historically it did not, which caused cash management headaches) and the remainder as it completes various milestones. This method in my view allows for some wiggle room in terms of when exactly to recognize revenue. Now I have never worked at a company similar to Kraken, or one that uses “percentage of completion” to recognize revenue, nor am I an accountant, so take that statement with a grain of salt. But the fact that these contracts are multi-year, with months needed to execute on various portions of delivery, I believe this gives management some discretion on revenue recognition. This does not explain why revenue has historically been so lumpy, so perhaps I am just completely wrong as you’d imagine management would have pulled on this lever historically to smooth out revenue if it could have. Would love someone who is an accountant or knows the business more intimately to chime in here in the comments!

Closing out this section, I am comfortable taking management at its word in terms of revenue growth, modeling FY23 top line of $72m (mid-point of guidance). I am also comfortable taking management’s guidance for adjusted EBITDA, although instead of modeling Kraken achieving its mid-point of $14.5m, I have been more conservative and have adjusted EBITDA of ~$13m for an adjusted EBITDA margin of ~18%.

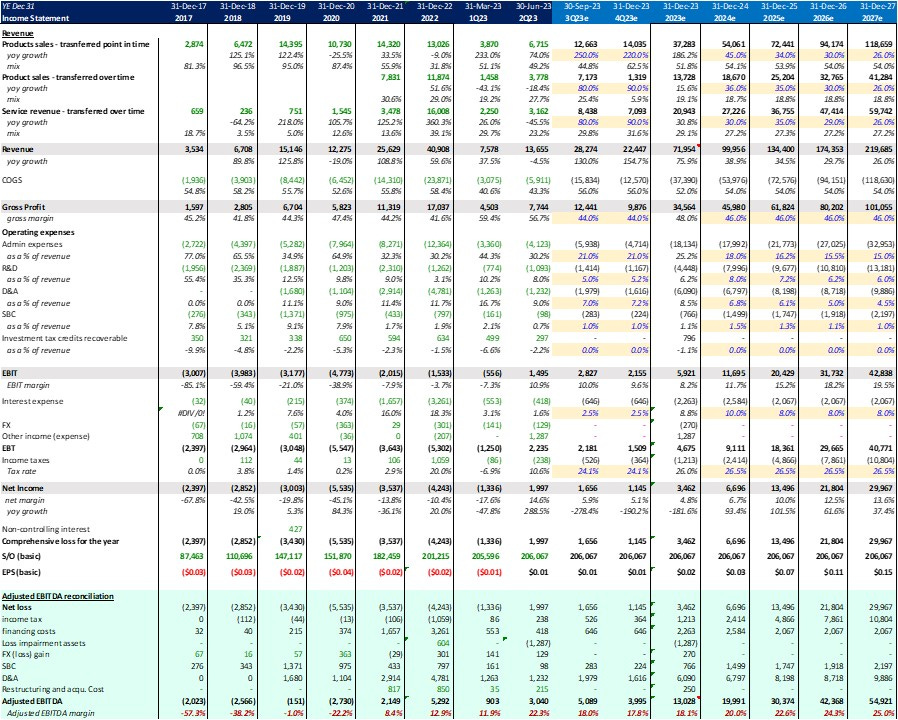

Modelling & Valuation

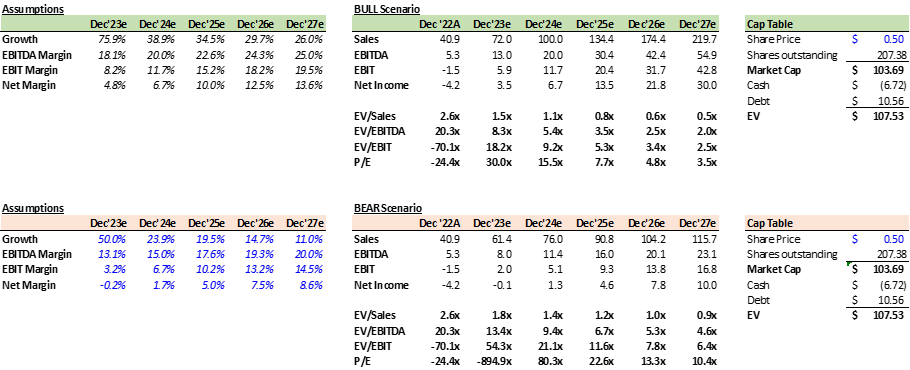

On top of the compelling 6-month outlook for Kraken, management has provided long-term guidance of revenue CAGR of 40% and adjusted EBITDA margins of 25% in recent investment presentations. Additionally, during a recent presentation at the Planet Microcap Showcase, management stated “as we look four to five years out, we think we can continue to grow the top line at 40% plus CAGR. Based on what we’re seeing with our product portfolio and what we’re seeing with our end market customers, and maintain margins in the 20% plus range”. The below model assumes management hits a 40% CAGR over the next 5-years and achieves a 25% EBITDA margin in the final forecasted year.

In FY22, Kraken reported revenue of ~$41m. Assuming management hits its mid-point of guidance, $72m in revenue in FY23 and subsequent years decline in a somewhat linear fashion, the company would hit revenue of nearly $220m at the end of 2027 to achieve its 40% CAGR goal. At the bottom of the income statement highlighted in green we see the Adjusted EBITDA reconciliation section. Here, I have margins improving from 18% to end FY23, slowly increasing to 25% as at the end of 2027. I would highlight that my revenue assumptions by line item have little to no substance, I probably should have just grew consolidated revenue as one line. As for gross margins, management has previously stated they aim for 45-50% per quarter depending on revenue mix. I have modeled 46% throughout forecast period, the low end of guidance (apologies for the blurriness, for the life of me I cannot upload it clearer but I have provided the excel doc for your reference.)

On Dec ‘23 figures, Kraken is trading at an EV/EBITDA multiple of ~20.0x, quite high for a high-risk, lumpy revenue micro cap. However, obviously with the strength in management’s financials projects, the forward numbers are far more attractive. The table below summarizes various valuation multiples per each year of the forecasted period above. As you can see, if you believe in management’s guidance, the stock is very cheap on multiples of EBITDA as early as FY24. A great comp table pulled from Cormark Securities in

write up shows that its peers trade at an average of 14.0x, or twice that of Kraken. The peer group in question is mostly enormous defense companies with much larger balance sheets and more diverse business segments so they definitely deserve to trade at a premium. However, I think one could argue that a company growing as quickly as Kraken, now achieving profitability and expanding margins deserves to trade at a greater multiple than the market currently gives it.Conclusion

I for one believe managements guidance…for now. I plan to follow the company over time to ensure it is indeed achieving the milestones that it sets out. There is far more to the story than the numbers I highlighted, so again I urge you to read up on the company through the links I provided above.

In conclusion, the chance to get in at a reasonable valuation is likely closing as the company reports its 3Q23 results at the end of November which I expect to be impressive. Although its not certain the stock immediately jumps on the results, I expect they may and therefor believe if you wanted to establish at least a minor position in company, its best to do it now and then average up over time as the company continues to execute. There is nothing tougher than learning about a stock, not investing, then seeing it run up well above where you could have initially bought and then overcoming that mental bias to invest at that higher level. I for one suck at it!

I hope you enjoyed the write up. If you have any questions or comments, please do share them! I hope to increase my volume of writing in the future and any feedback would be greatly appreciated. Thank You!

https://krakenrobotics.com/kraken-reports-strong-growth-in-2018-and-provides-outlook-for-2019/

https://krakenrobotics.com/kraken-provides-2021-guidance-of-100-revenue-growth-and-preliminary-q1-financial-results/

https://krakenrobotics.com/kraken-reports-record-2021-financial-results/

Nice piece OJ. The lumpyness of rev and variable margins have always been tough for me to stick with it. Will be following along mode closely now to see how it plays out. Best of luck on the position